Wheat Outlook for 2019-20 and Risk Management for the 2020 Crop

Wheat Science Newsletter - August 27, 2019 Volume 23, Issue 4

Todd Davis—Extension Grain Marketing Specialist

While the grain markets continue to struggle with understanding the size of the 2019 corn and soybean crops, the market pretty well understands the 2019 winter wheat crop’s estimated production. As of August 19, USDA’s weekly Crop Progress report pegged the winter wheat harvest in the U.S. as 93% completed. At this point, the market will focus on the demand side of the balance sheet, as the supply estimates will not change substantially in future reports.

USDA estimates the 2019 wheat crop, for all types of wheat, at 1.98 billion bushels. If realized, the 2019 crop will be 96 million bushels larger than last year’s crop. With a smaller carry-in and the same projected amount of imports, the 2019 wheat supply will be slightly larger than last year at 3.18 billion bushels (Table 1).

The demand side of the balance is projected to be almost the same as last year with total use projected to increase by 127 million bushels. Food use increases with the population, and USDA’s current estimate is 960 million bushels. USDA projects feed use to increase due to the potential smaller corn crop, especially in the Plains states. USDA currently projects exports to increase slightly from last year. Since the U.S. is the residual supplier, this export number could increase in response to a production problem elsewhere.

USDA currently projects ending stocks to decline slightly from last year to a little over 1 billion bushels. Prices typically respond higher whenever stocks decline; however, USDA projects the 2019-20 U.S. marketing-year average to be a little lower at $5.00 per bushel.

Protecting Price for the 2020 Wheat Crop

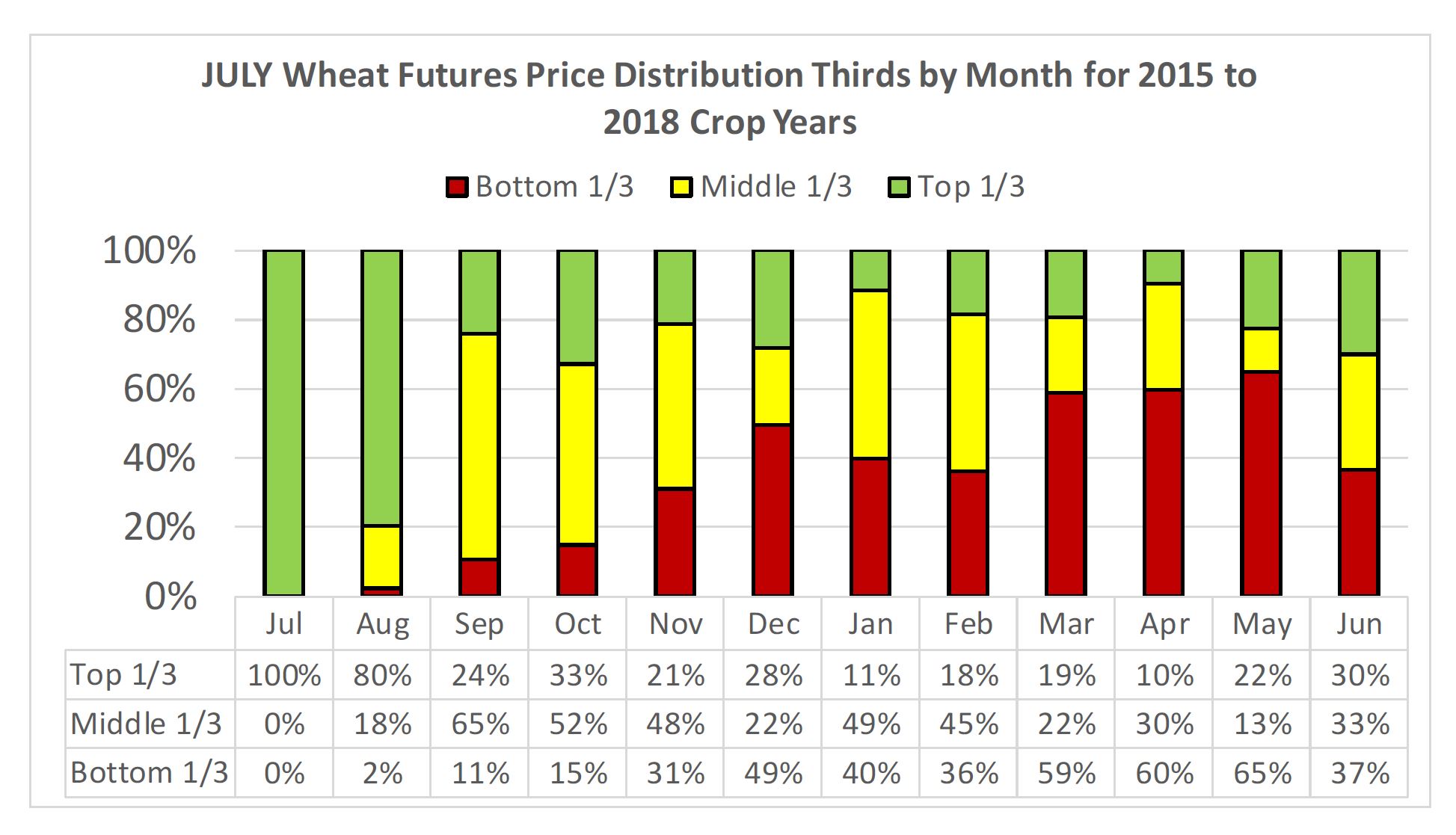

Sometimes the best time to price a crop is before the seed leaves the bag. This has been the case for wheat for the 2015 to 2018 crops as the July Wheat futures contract traded in the year’s top-third trading range mostly in July and August. Figure 1 shows the frequency of the July futures contract closing in each year’s trading range in the top, middle, or bottom price range. The seasonality in the futures market is clear as the futures price tends to trade lower once the crop breaks dormancy and approaches harvest. Better pricing opportunities have been in July, August, and into September as the market prices in a minor premium for wheat. Given the potential carryout of over 1 billion bushels, the market does not have to provide a substantial premium now. If weather conditions worsen into fall seeding, then the market may provide another pricing opportunity.